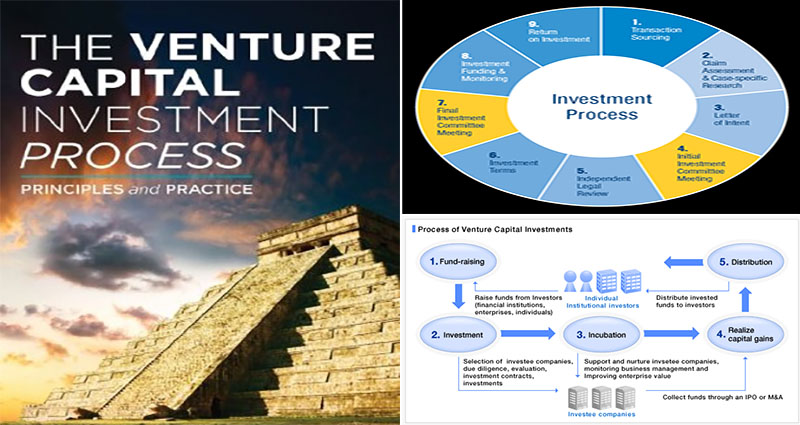

The Venture Capital Investment Process

The initial phases of the VC process involve the look for investment possibilities and evaluating management teams. Afterward, the venture firm allocates its capital to businesses with powerful prospects. Most VC firms will hold a minority stake within the firms they invest in. Because of this, they will be far more most likely to become in a position to retain the high-quality people today on their Board of Directors. Additionally, the initial investment process involves a thorough assessment of the company’s business model, the marketplace potential, and the item or service.

Startup Stage

The initial stage of an organization comes immediately after the seed or startup stages. The item is now offered in the marketplace as well as investors can see how it performs. The initial stage also involves additional sales and manufacturing. The level of investment at this stage might be larger than in the preceding stages. The company requires to hold its own against the competitors and ensure that the new item can hold its worth. Within an initial couple of years of its life cycle, the business may have a likelihood to prove itself.

The Initial Stage

The subsequent stage of an enterprise is the 1st stage. This occurs immediately after the seed or startup stage. At this stage, the solution has already been developed and is out there within the market. This allows the investors to find out how it performs within the marketplace. Within this phase, the organization could also need added marketing and advertising, … READ MORE ...