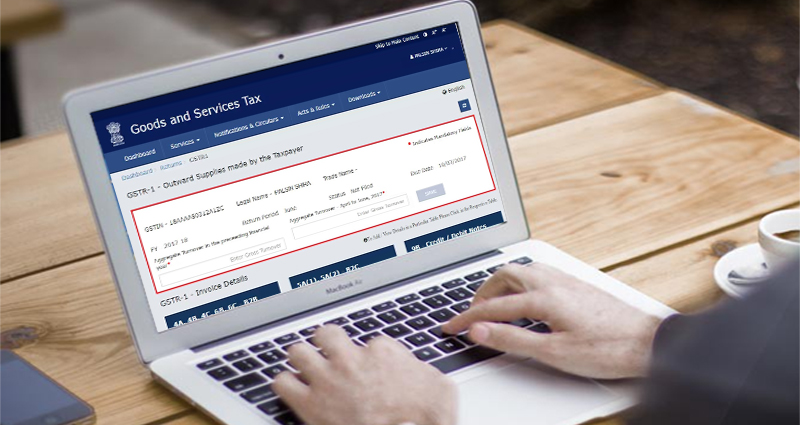

All You Need To Know About Gstr 1 Return Filing

The Goods and Services Tax has different types of systematic tax-paying methods. Gstr 1 return filing form is one of the many. It is a detailed tax return form that was introduced during the reformation and application of the Indian tax system through GSTN. Every registered taxpayer whose annual turnover is more than Rs 1.5 crore has to submit the outward supply details on the 11th of every month by filing gstr 1 return. Individuals whose turnover does not exceed more than 1.5 crores have to file the gstr 1 return quarterly.

What is Gstr 1?

As mentioned earlier, gstr 1 is a type of document where every registered taxpayer has to mention the details of their transactions. It is the initiation of processing input credit tax to the supplier. All the details of sales and supplying of goods need to be reported by the supplier during the tax period. It is also to be noted that even if there is no transaction that occurred in the entire month, the taxpayers still will have to submit gstr 1 return. Taxpayers can also continue submitting their invoices each month.

Who does not need to file gstr 1?

Following individuals are not obliged for gstr 1 return filing:

- Individual responsible to collect TDS

- Taxpayers eligible for TDS collection

- Online Information Database Access and Retrieval (OIDAR) Services suppliers

- Taxable individuals who are nonresidents

- Taxpayers registered under the GST composition plan

- Input Service Distributors (ISD)

Features of Gstr 1 return form

Following are the … READ MORE ...

But 2013 annual business performance information from Cambridge Associates shows that venture capital continues to underperform the S&P 500, NASDAQ and Russell 2000. For the most effective performing funds, significantly less than 20% of their deals create 90% of the returns. Please see the table beneath to see how returns are affected by time and a number of. Plus numerous funds that have been actively investing in 2016 slowed their pacing meaning this year they’ll be hunting to put their funds to operate.

But 2013 annual business performance information from Cambridge Associates shows that venture capital continues to underperform the S&P 500, NASDAQ and Russell 2000. For the most effective performing funds, significantly less than 20% of their deals create 90% of the returns. Please see the table beneath to see how returns are affected by time and a number of. Plus numerous funds that have been actively investing in 2016 slowed their pacing meaning this year they’ll be hunting to put their funds to operate. Returns of individual investments at major performing funds are dominated by a few organizations. In spite of the venture market’s cyclicality, the VC Index did outpace public markets more than the last one particular-, three-, 5-, ten-, 20- and 25-year periods – though it underperformed more than the last 15-year period, due to the bursting of the early-2000s venture bubble dragging down the market return,” mentioned Theresa Hajer, Managing Director, Private Development Investigation at Cambridge Associates.

Returns of individual investments at major performing funds are dominated by a few organizations. In spite of the venture market’s cyclicality, the VC Index did outpace public markets more than the last one particular-, three-, 5-, ten-, 20- and 25-year periods – though it underperformed more than the last 15-year period, due to the bursting of the early-2000s venture bubble dragging down the market return,” mentioned Theresa Hajer, Managing Director, Private Development Investigation at Cambridge Associates.